Summary

Near each year end, mutual funds tally up their realized gains and losses, and when gains exceed losses, they must distribute those net gains to shareholders of the fund. All shareholders as of the record date receive these distributions and must pay taxes on them at either capital gains or ordinary income rates. Because the tax implications could be meaningful, investors should review the estimated distributions for each fund against their cost basis and determine whether they should sell the fund before the record date. For savvy investors, this represents a time to consider whether more tax-efficient investment options are available. Volatile markets present a valuable opportunity for investors to make these transitions at a lower cost while preventing future tax bills.

Full Version

As we approach the end of another busy year, it’s once again time for investors to brace for capital gains distributions from their mutual fund holdings. Similar to how we as investors report net realized gains and losses, so too must mutual funds tally up their realized gains and losses at the end of each fiscal year, and when gains exceed losses, they must distribute those net gains to shareholders of the fund. Those distributions are then taxed to the shareholder in the year they are received. All mutual funds, both active and index funds, must make these distributions.

To decide who receives a portion of the fund’s gains, the fund selects a “record date.” Any investor who owns a portion of the fund on that date will receive a pro rata portion of the fund’s gains that year. It does not matter at all whether a shareholder bought the fund three weeks or three years earlier; all shareholders as of the record date receive the distributions.

The fund pays the distribution on its “payable date,” and the distribution is included in the investor’s income tax calculations for that tax year. If assets sold by the fund as part of the distribution were held for over a year, that portion of the distribution will be taxed to all shareholders at capital gains rates; for assets sold less than one year after purchase and included within the gain, that portion of the distribution will be taxed at shareholders’ ordinary income tax rates. Remember, whether these distributions are taxed at more favorable capital gains rates or more onerous ordinary income rates is based solely on the assets the fund manager decided to sell; it is not based on how long the shareholder has owned shares in the mutual fund. The only way to avoid receiving, and paying taxes on, a fund’s capital gain distribution is to sell the entire position before the record date. Of course, the decision to sell the fund is also a taxable event for investors holding the fund in non-qualified accounts (e.g. taxable investment accounts), which should be considered with a tax or investment professional.

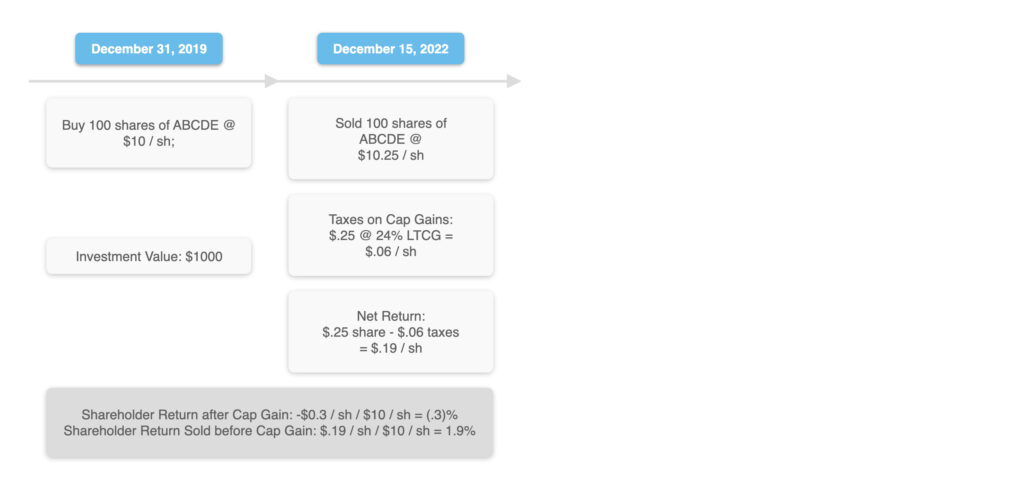

With equity markets well off their highs, many investors have seen gains in their mutual fund positions eroded away. In some instances, the investor may be better off selling their funds before receiving those distributions:

And if the investor decides to sell the mutual fund before the capital gain distribution:

This is the decision investors should be reviewing today and every year when invested in a mutual fund: whether they should sell these mutual fund positions before the fund pays out capital gains. Because both stock and bond markets have sold off the last 12 months, many investors may be able to sell out of their mutual fund positions with a smaller tax hit than in the past.

Historically, following periods of high volatility or large drawdowns in the stock market like we’ve seen this year, the following years’ capital gain exposures have been very high. In 2021 for example, following the 34% sell-off during the Pandemic bear market in March 2020, capital gains distributions more than doubled to $822bn from the previous year. There are several reasons for this, but a prominent reason is that investors will often raise cash during market sell-offs as a way to protect against volatility. When investors sell their mutual funds, the mutual fund manager must in turn sell assets within the fund to raise cash to meet those redemptions. This often includes assets that had been held at a gain, either short-term or long-term, and the shareholders who stayed the course must then bear the tax consequences at year-end.

Another reason capital gains distributions have trended upwards in recent years is the challenge mutual fund managers face trying to beat their benchmarks. According to recent data, 92% of domestic fund stock pickers have failed to outperform their benchmark over a 10-yr basis. Many active managers feel that to outperform they must trade their stock positions more frequently, to capture changes in market sentiment and valuations, but more frequent trading often leads to larger capital gains.

There is a silver lining to the volatility we’ve seen so far this year, and that is the ability for savvy investors to capture “tax alpha.” Tax alpha is the value created when investors take advantage of tax laws to reduce or eliminate tax bills they may have incurred otherwise. This may mean tax loss harvesting positions in their portfolio. These losses don’t expire, so they can be used the year they’re taken or saved for a future gain. It may mean deferring sales on assets that will soon move to long-term holds and thus more favorable tax rates. And it may also mean the opportunity to “sell low” out of tax-inefficient mutual funds or ETFs and reinvest into more sophisticated direct indexes. Direct indexing offers investors nearly identical exposure to all the most commonly-used benchmarks, but because they’re built with individual securities within a client’s own portfolio, they’re not affected by other investors’ redemption decisions that may force out year-end capital gain distributions.

A large shift in assets from mutual funds to direct indexes has occurred over the past several years and today these direct indexes have even become cheaper to invest in than most active mutual funds. However, you don’t reap the tax and customization benefits of direct indexing just by owning the individual stocks. A direct index needs to be managed by a specialist and Altium Wealth has removed this barrier to entry for its clients.

Ryan Darmofal, CFA, FRM, CPWA®

Vice President, Wealth Strategies

Appendix

1 – Source: 2022 Investment Company Fact Book, the Investment Company Institute, www.ici.org

2 – Source: SPIVA U.S. Scorecard, S&P Dow Jones Indices LLC, data as of June 30, 2022, www.spglobal.com

Hightower Altium Holding, LLC is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.